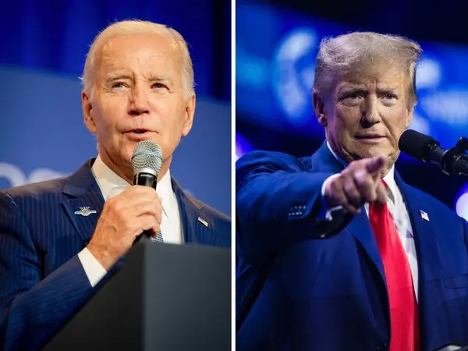

When Donald Trump contracted the Covid-19 virus in October, he was medevac’d by helicopter to Walter Reed National Military Medical Center where a team of 12 doctors monitored his vital signs, supplied him with supplemental oxygen, injected him with Remdesivir, a viral inhibitor, and gave him Regeneron, an experimental antibody cocktail not yet approved for general use. Mr. Trump recovered from the virus at an estimated cost of $100,000 not counting the helicopter ride to and from the White House. American taxpayers paid for all of it.

In an irony of ironies, if you’re one of the 20 million Americans whose health care is covered by the Affordable Care Act (Obamacare), the guy whose medical bills you just paid is trying hard to take your coverage away.

Unfortunately, American taxpayers don’t have access to Mr. Trump’s level of care. What they have is a confusing mix of private, government, and employer-based insurance plans anchored by the Affordable Care Act (ACA), Medicare, and Medicaid.

The ACA, enacted by Congress in 2010, was the best Congress could do, at the time, to offer uninsured Americans, including those with pre-existing conditions, healthcare coverage. Since its passage, ACA opponents have tried to “repeal and replace” (mostly repeal) it at least 70 times (Newsweek) and have taken it to the Supreme Court twice—most recently last week—in an effort to have it declared unconstitutional.

Here’s the great mystery… why would any American want to prevent other Americans from having access to affordable health insurance? We’re in the middle of the worst pandemic in 100 years. Over 250,000 fellow Americans are dead, many others hospitalized, millions have lost their jobs. The ACA is their healthcare safety net, yet conservatives want it repealed without offering a replacement plan.

According to the Center for American Progress, if the law is invalidated more than 20 million people will lose their health coverage and 135 million with pre-existing conditions (including Covid-19 survivors) will be left without access to affordable insurance.

Conservatives argue the law amounts to socialized medicine, an argument left over from Ronald Reagan’s “red menace” conservativism, yet the law is overwhelmingly popular. The argument escapes me; their America already has Social Security, Medicare, public education, food stamps, TSA, air traffic control, and subsidized agriculture. There are laws mandating drivers licenses and automobile liability insurance. So why is health care such a socialist threat?

The Commerce Clause of the US Constitution grants Congress the power “to regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes.” From its earliest history the court judged commerce to mean “the activity of selling, trading, exchanging, and transporting goods and people, as distinct from producing the things being moved.” In a 1944 Supreme Court case (United States v. South-Eastern Underwriters) commerce was deemed to include “a business such as insurance.” (National Constitution Center)

I’m not an originalist, a textualist, or any kind of constitutional scholar but one approach to legal interpretation I learned in law school is “the plain meaning rule.” There is a presumption in favor of the plain meaning of a statute’s words. Congress has the power to regulate commerce, including insurance, under the authority of the Commerce Clause. The plain meaning is clear.

I’m not covered by the ACA. As an older American I qualify for Medicare, but this case is more important than how it affects me. It affects millions of my fellow Americans. Here’s the overview of its history:

- The final version was signed into law by President Obama on March 23, 2010. As a condition of its passage, health insurance was made “mandatory” for all adult US citizens. This provision, referred to as the “individual mandate,” was inserted to ensure the “risk pool” included enough healthy people to lower and spread the cost across all enrollees. The mandate included an opt out provision such that if the taxpayer opted not to purchase insurance he or she would pay a penalty. This provision was inserted to prevent people from waiting until they got sick to purchase insurance. Buy now or pay a penalty.

- The mandate’s constitutionality was challenged by taxpayers in several states as a violation of the Commerce Clause. Could the government order all Americans to purchase health insurance? The challenge asserted the mandate was an unconstitutional application of the Commerce Clause and therefore not within Congress’ authority.

- The case reached the Supreme Court in 2012 where the law was upheld in a 5-4 decision with Chief Justice Roberts holding that the mandate’s “penalty” was a valid exercise of Congress’ power to tax and not a Commerce Clause issue.

- Attacks on the law’s constitutionality continued even after Congress repealed the penalty (tax) provision in 2018. The Supreme Court granted a second hearing in the 2020 term when the Fifth Circuit Court of Appeals ruled the mandate unconstitutional and so integral that the entire law should be invalidated. This is the case the Supreme Court heard last week. It was brought to the court by the Texas Attorney General, 26 Republican attorneys general, and the Trump Justice Department, arguing that the mandate is so integral to the ACA that if it is unconstitutional the whole law is unconstitutional.

- On Tuesday November 10, one week after the Presidential election and eleven days after the installation of Amy Coney Barrett as an Associate Justice, the court heard oral arguments with a decision expected before the end of the 2020 term in June.

I got up early on November 10th (Marine Corps birthday) to listen to the oral arguments on C-Span 1. This is really dry stuff, but it might be life or death for those covered by the law. If you’ve never listened to oral arguments, I recommend it. The Chief Justice controls the questioning, the proceeding is formal, and the participants all respectful. Very different from the political dialogue of our time.

Oral argument, in this case, turned on two legal questions: did the plaintiffs (the challengers) have “standing” to bring the case and if they did would their argument “on the merits” persuade the justices to rule the ACA unconstitutional? On the first question, plaintiffs had to show they suffered “damages.” You can’t just show up at the Supreme Court (or any court) and complain about a law without “standing” i.e., that you’ve been injured by it. If not, you don’t get to argue the “merits.” or substance of the case. Texas claimed financial injury caused by the burden of increased paperwork. Sounded weak to me.

On the merits side, the plaintiffs argued that because the individual mandate was ruled unconstitutional by the Fifth Circuit, the entire law was flawed and should be declared invalid. It’s often difficult to read the outcome of a case from the justices’ questions but it seemed that the Chief Justice and Justice Kavanaugh were both skeptical that the mandate (repealed by Congress in 2019), even if unconstitutional, should invalidate the whole law. Their questions turned on “severability,” a doctrine that says if one part of a law is invalid the remainder can be saved by severing that provision and leaving the rest intact. Since Congress had already zeroed out the mandate’s tax provision and it was no longer a factor, severing it from the larger act would allow the law to remain in force. Most of the legal commentators agreed that it is likely the ACA will survive. The ACA is not perfect, but Congress has a chance to improve it. We’ll see if Congress under a new administration has any appetite for work. The ACA can’t be fixed by Executive Order. It will take bipartisan Congressional support to make the necessary changes. My fingers are crossed.

62 days remaining until the inauguration and we can breathe again.

Who gains if the ACA is gone?

Nice concise understandable review Jack

Thanks

I definitely learned a lot about ACA reading this. Very cogent arguments translated for non lawyers.